SUSTAINABILITY & SMALL BUSINESS BLOG

Retail Debt in Sustainable Fashion

RETAIL DEBT IN SUSTAINABLE FASHION

We are all familiar with the feeling of disappointment when you desire something that is just over your budget, whether it be a new coat for winter or a pair of shoes that you’ve been dying to get your hands on. Some of us may already be acquainted with Buy Now, Pay Later (BNPL) schemes which have enabled people to purchase what they cannot afford, for example paying in instalments or within a 30 day period. Prior to this, we may have stuck an impulse purchase on a credit card or store card – now all that is required is a click of a button. So, what does this mean for overconsumption of fast fashion and the knock-on effects on the environment? And how ethical are ‘sustainable’ brands that offer BNPL services to their customers, aware of the implications that can happen?

Recently Buy Now Pay Later schemes (BNPL) have crept into online checkouts as an option when paying, which you may have noticed or even used yourselves if you are a regular online consumer. These come in the form of companies such as ClearPay, AfterPay, Laybuy, Affirm with the most popular in the UK: Klarna. These companies have collaborated with fast-fashion retailers such as Topshop, Schuh, brands under BooHoo Group PLC, ASOS and many more including small and sustainable brands.

The Swedish firm worth $2.5 billion, founded by Sebastian Siemiatkowski was introduced to the UK in 2017 – within the first year of business, 19 million people had used Klarna at least once in the UK.

Klarna masks the dark reality of retail debt behind its millennial pink exterior as well as concealing their status as a bank after gaining a bank licence – Luke Griffiths, the UK General Manager of Klarna revealed, “We consider ourselves obviously a bank.”

HOW IT WORKS

Klarna offers it’s consumer 3 options of payment: Pay Now, Pay Later or ‘Slice It’. The first 2 options translate to a soft credit check and a 0% interest rate whereas the ‘Slice It’ option is the equivalent to using a credit card which results in a hard credit check and an 18.9% interest rate per annum.

If you fail to make a payment to Klarna, the debt will be passed on to a debt collection agency, which in effect will damage the credit score of the customer. This information only recently came to surface when the company made a ‘subtle’ amendment to their statement on the Klarna website.

‘Go Fund Yourself’ an organisation started by Alice Tapper is campaigning for stricter advertising standards and improved customer protection against Klarna and other BNPL schemes that are capitalising on the lack of awareness of younger generation of consumers and deceptive marketing.

These BNPL schemes allow more expensive purchases more accessible to those who don’t have a disposable income. However it should not be dismissed that BNPL companies such as Klarna can be incredibly problematic.

LACK OF CUSTOMER PROTECTION AND DECEPTIVE MARKETING

Klarna is known for displaying incorrect information and using deceptive language that leads young consumers into overspending as well as failure to make payments. Klarna’s ‘No Fees, Never’ slogan that is used across their adverts intentionally plays on the naivety of their younger consumers whilst lulling them into a false sense of security.

The company brags to their retailers that by offering Klarna as a payment method, ‘the customers value increases by 55%’ meaning that it is guaranteed consumers will buy more than they can actually afford. To make matters worse, the demographic that is more likely to use Klarna are younger people who will most likely already be in debt with Student Finance or have an overdraft. The last thing they need is to be tempted with unnecessary debt from something as simple as buying clothes.

As the Financial Times pointed out, this new generation of consumers would not have been old enough to remember the catastrophe that was the financial crisis of 2008, therefore, they cannot be blamed for companies such as Klarna who have ‘rewritten the language of debt’ to mislead consumers.

Whilst being a student and as a post-graduate, I have used Klarna when making purchases online with the mindset that this was a beneficial way of holding onto my money. As the consumer I felt comfortable that Klarna had taken care of everything and willfully ordered more clothes than I needed as I wasn’t having to pay upfront for any of it.

The trickery comes when the parcel that contains your entire wishlist arrives at your door and you don’t have the willpower to return anything, leaving you with a bill that exceeds way over your original budget. Luckily in my experience, I was always on top of payments, however, I had started to notice that not only was I overspending when using Klarna but that I was actually over-consuming as well.

ENCOURAGING OVER CONSUMPTION

Buy Now, Pay Later companies like Klarna make their profit by guaranteeing that customers will overspend when shopping at desired retailers which is why more and more online stores are jumping on the BNPL bandwagon. With the emergence of COVID-19 people were online shopping more than ever due to lockdown periods resulting in unnecessary purchases in an attempt to satisfy boredom. It wasn’t long before Klarna jumped into action by releasing a video campaign in Australia blatantly encouraging people to consume online to keep entertained. The music video ‘Get What I Love’ featured famous Australian artists; The Inspired Unemployed, Thandi Phoenix and Tuka.

This video campaign is yet again another example of how Klarna has cleverly used paid celebrity endorsement and influencer marketing to positively enforce the concept of overconsumption.

Whilst this has become a widespread marketing tool, more responsibility needs to be taken by individuals who are paid to promote brands. With influencers frequently failing to state #AD on paid social media posts, it is becoming harder and harder for people to make conscious decisions when consuming. Not to mention the lack of risk wording used by influencers or BNPL marketing campaigns when promoting these schemes to their audiences, many of which are young and impressionable. None of the above warn followers or customers that BNPL schemes need to be used responsibly and with consideration, as they can do more damage than good.

ETHICS AND SUSTAINABILITY

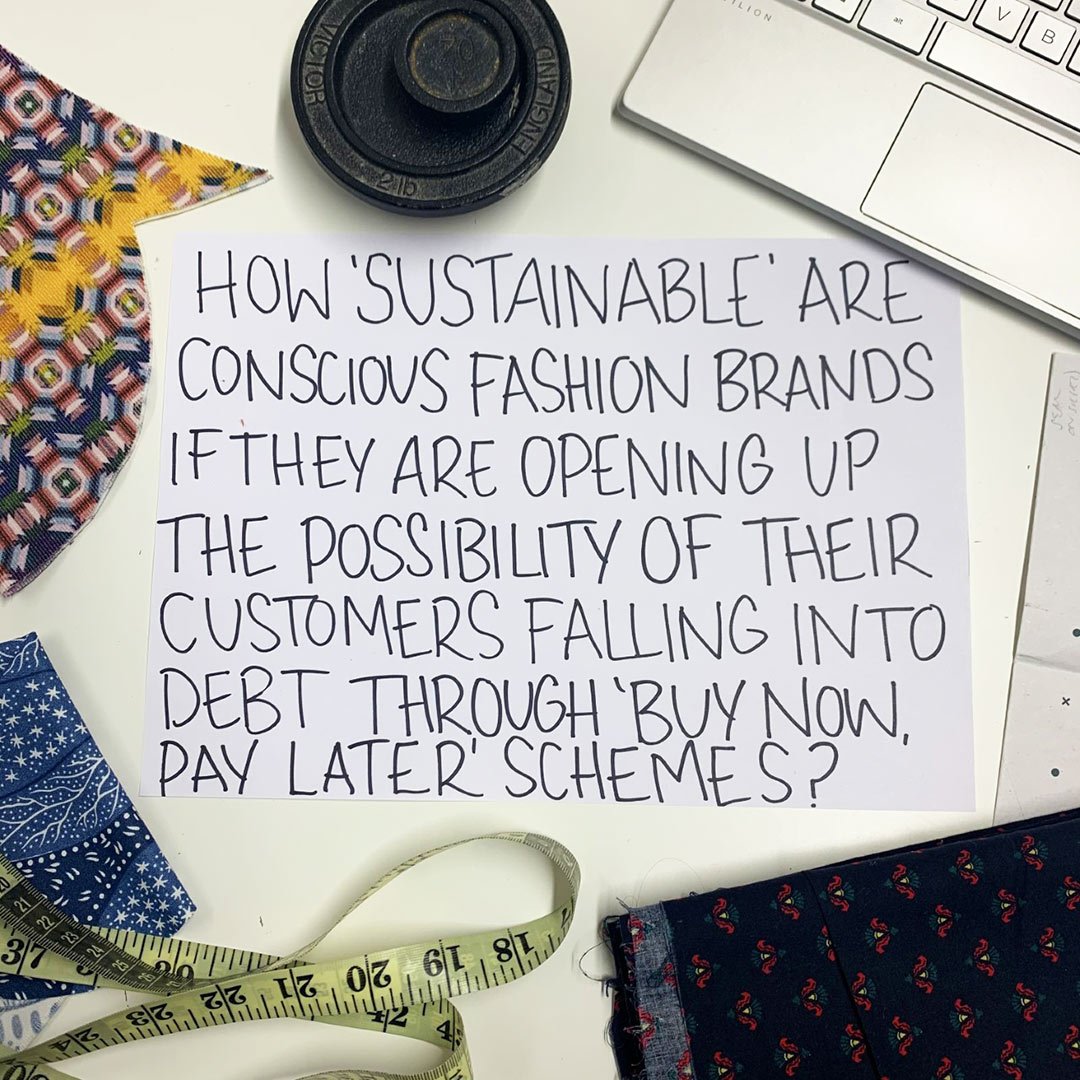

Another question to address, is how ‘sustainable’ are ethical clothing brands if they are opening up the possibility of their customers falling into debt? Brands such as Reformation, Everlane and Lucy and Yak all offer Buy Now Pay Later options for their customers. Whilst this encourages customers to invest in sustainable products like environmentally friendly clothing, it is difficult to see how the brands’ ethics align with allowing their customers to potentially fall into debt. This feels like lack of thought on brands’ part at best and greenwashing at worst.

As sustainable fashion expert Aja Barber shares on her Patreon, that she’s in the ‘nah camp’ for Buy Now, Pay Later schemes as they encourage people to see debt as a valid option rather than saving up for something and then making your purchase. Responsible clothing comes with responsible selling practices.

ALTERNATIVE PAYMENT PLANS

Alternative methods of payment are not all bad and can be beneficial for the customer. For example, Cashmere, an online micro-savings service, guides you on a journey to saving up for an investment piece whether it be shoes, clothes or accessories. The new initiative was set up by female entrepreneur Urenna Okonkwo, taking a Save Now, Buy Later approach to making more expensive purchases. Not only does the company offer a service, but Cashmere has also hosted workshops for young females that give advice on saving & budgeting, debt management, investments, and personal protection/ insurance.

At The Emperor’s Old Clothes, we believe our customers should have access to making investment purchases on sustainable clothes that are going to last a lifetime. We offer payment plans starting at 2 months up to 6 months – these operate in-house with 0% interest, so there are no hidden traps if you miss a payment, instead, you will receive a friendly reminder from us if you miss a payment! This way it encourages slow consumerism as customers will receive their order once the payment has been made in full, we believe that this is the pace of true slow fashion and investing in a wardrobe of sustainable clothing.

Payment plans don’t have to put you at risk – by researching the best payment method for your financial situation, you can shop for ethical clothes responsibly knowing you aren’t running the risk of damaging your credit score or ending up in debt. On the other hand, if you’re afraid to shop for your dream sustainable dresses, for example, using payment plans you can always search for your item to see if anyone is selling it secondhand or wait for seasonal sales where you might be able to purchase with a reduction off the original price! Check out Emperor’s Resale which is updated bi-monthly

Written by Cressida Drummond-Hill, Marketing Assistant; edited by Cecily Blondel, Owner